We require all customers to have a valid insurance policy before they can purchase a vehicle, including collision and comprehensive coverage. At the time of sale, the buyer of the Ford Mustang (pictured) had valid auto insurance, purchased the car, and drove it off the lot. Then he let the insurance policy lapse to try and save money, but it backfired… big time. Now he doesn’t have a working vehicle and he is still responsible for the full amount of the car loan.

When you purchase a vehicle, it isn’t enough to just make your loan payments on time; you must also maintain your auto insurance or face repossession.

Auto Insurance Protects You and Your Investment

The purpose of auto insurance is to protect you against financial loss in the event of an accident or theft. In exchange for paying your monthly premium, the insurance company agrees to your losses as outlined in your policy.

Without insurance, you’d be on the hook to pay all losses out of pocket. The buyer of the Mustang had to learn this the hard way. Without insurance, he’s now personally financially responsible for the full amount of the unpaid car loan, and the car he’s now paying on is essentially worthless. He endangered his family, himself, and his credit. In the end, his decision will end up costing him over 100x what he tried to save by letting the insurance lapse.

Having collision and comprehensive insurance is an adult responsibility. It protects not just the car and your credit, but also your passengers who are often your children and other loved ones.

Had the customer still had the required insurance policy at the time of the accident, the insurance would have covered the majority of the cost.

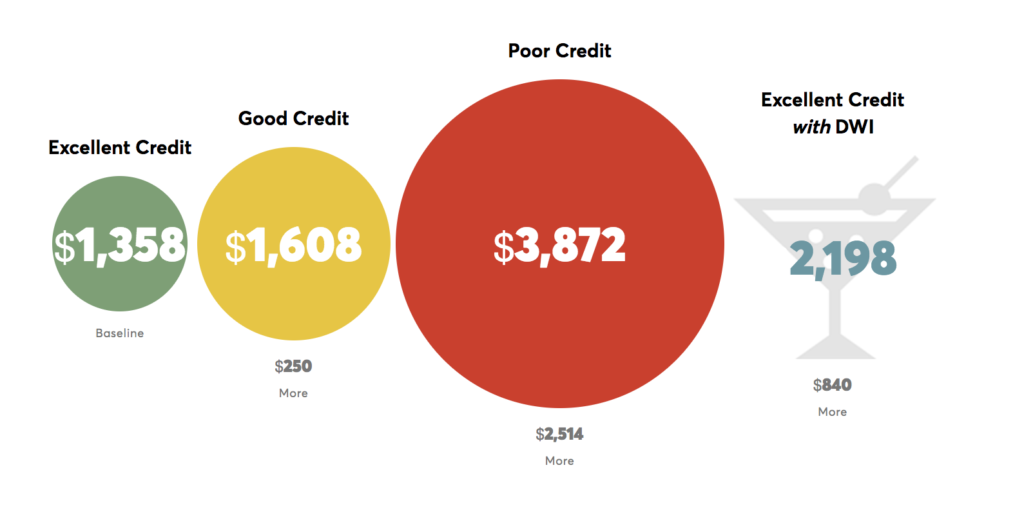

Your Credit Score Affects Your Insurance Rate

Insurance companies base their rates in part on a customer’s credit rating. Just as your credit score is used to measure your creditworthiness – the likelihood that you’ll pay back a loan or credit card debt — your credit score is also used by auto insurers to predict the odds that you’ll file a claim. Even if you’ve never had an accident before, they may charge you more for your insurance premiums if your credit score isn’t up to their standards.

If you’re one of the many Oklahomans affected by poor credit, the best thing you can do is raise your credit score. This is not something you’ll be able to do overnight, but it doesn’t have to be as complicated as it seems.

Rebuild Your Credit with Integrity

Making timely payments on a car loan is a great way to help you rebuild your credit. Unlike most Buy Here Pay Here dealers, Integrity Auto Finance reports to all three credit bureaus, ensuring that your on-time loan payments will effectively help you rebuild your credit.

![The Integrity Difference: Easy Financing & Payment Options [video]](https://www.integrityautofinance.com/wp-content/uploads/2019/02/integrity-difference-easy-financing-payment-options-450x189.jpg)

![Rebuild Your Credit with Integrity [video]](https://www.integrityautofinance.com/wp-content/uploads/2018/12/rebuild-your-credit-with-integrity-450x189.jpg)